What is Amazon FBA?

Fulfillment By Amazon (FBA) is one of the three fulfillment methods offered by Amazon. With this program, sellers send inventory directly to Amazon fulfillment centers, and Amazon fulfills orders on behalf of the sellers.

FBA is a good option for sellers looking to offer fast Amazon Prime fulfillment, save time, and grow their businesses. However, you must pay FBA fees to use this fulfillment program. Plus, the price your business pays overall depends on the business structure you select.

When selling via FBA, keep in mind that the Amazon fulfillment fee determines the amount of profit you’ll make. Therefore, it’s essential to understand what Amazon’s FBA cost encompasses before taking the plunge.

Wrapping your head around FBA fees can be challenging, so in this blog post, we’ll walk you through FBA fees, how Amazon calculates the fees, and other basics you need to know regarding FBA costs.

What are Amazon FBA fees?

These are the fees that you pay Amazon to fulfill your orders on your behalf via FBA. The fulfillment fees vary based on the type and size of the items stored and shipped, the product’s weight, seasonality, and a variety of other factors.

Common FBA fees

The following are the standard FBA fees you need to know about:

1 – Fulfillment fees

Amazon fulfillment fees cover everything that goes into the process of fulfilling orders on the seller’s behalf. You pay Amazon to pick your inventory, pack the products, ship them to the customer, and provide customer service. Amazon fulfillment fees are calculated per unit.

Amazon fulfillment fees for standard-size products start from $2.41 to $4.71 and depend on weight. There’s an additional fee of $0.38 per pound for products weighing over two pounds.

For oversize products (products that exceed 18” x 14” x 8”), Amazon charges from $8.13 to $137.32 as fulfillment fees, and these fees vary based on size classification.

Oversized products are categorized into four tiers: slight oversize, medium oversize, large oversize, and special oversize.

Amazon fulfillment fees for small oversize FBA products (those weighing over 70 pounds or measuring more significant than 60” on the longest side) start from $8.13, with an additional $0.38 per pound over the first two pounds.

For unique oversize products weighing over 150 pounds or measuring more than 108” on the longest side, start from $137.32. There’s also an additional $0.91/pound over the first 90 pounds.

2 – Referral fees

These are the fees that Amazon charges for each item sold. Typically, referral fees for FBA <pro’s/cons’s> range from 8% to 15% and may vary from one category to another. Below is the current list of Amazon’s referral fees for various categories:

- Amazon Device Accessories – 45%

- Baby Products (excluding baby apparel)- Referral fees for products with a total sales price up to $10 is 8% and 15% for those with a total sales price exceeding $10.

- Books – 15%

- Camera & Photo – 8%

- Cell Phone Devices – 8%

- Consumer Electronics – 8%

- DVD & Video – 15%

- Electronic Accessories – Referral fees for electronic accessories with a total sales price of up to $100 is 15% and 8% for those with a total sales price exceeding $100.

- Furniture & décor – Referral fees for products with a total sales price up to $200 is 15% & 10% for those with a sales price exceeding $200.

- Home & Garden (including pet supplies) – 15%

- Kitchen – 15%

- Kitchen Appliances – 15%

- Music- 15%

Additional Amazon referral fees:

- Musical Instructions – 15%

- Office Products – 15%

- Outdoors – 15%

- Personal Computers – 6%

- Sports (excluding sports collectibles) – 15%

- Software & Computer/Video Games – 15%

- 3D Printed Products – 12%

- Video Game Consoles – 8%

- Unlocked Cell Phones – 8%

- Toys & Games – 15%

- Tools & Improvement – 15% (but referral fees for base equipment power tools is 12%)

- Gift Cards – 20%

- Clothing & Accessories – 17%

- Collectible Coins – 15%

- Watches – Referral fees for watches with a total sales price up to $1500 are 16% and 3% for watches with a total sales price exceeding $1500.

- Luggage & Travel Accessories – 15%

- Shoes, handbags, and sunglasses – Referral fees for products with a total sales price of up to $75 is 15% and 18% for products with total sales exceeding $75.

- Grocery & Gourmet Food – Referral fees for products with a total sales price of up to $15 is 8% and 15% for products with a total sales price exceeding $15.

The comprehensive list of categories and FBA fees can be found here on Seller Central (login needed).

Photo by Depositphotos

3 – FBA Storage Fees

Storage fees cover the cost of storing and maintaining inventory in their fulfillment centers. There are two types of FBA storage fees – monthly storage fees and long-term storage fees.

3a – Monthly storage fees

Amazon charges you a fee at the end of the month for storing your products in their fulfillment centers. FBA monthly storage fees are primarily based on the size and weight of your product. Amazon categorizes items into product size tiers—standard size and oversize. Standard size products weigh 20 lbs. or less, and their dimension doesn’t exceed 18” x14” x 8. On the other hand, oversized products exceed 20 kg. After packaging and their size exceeds 18” x 14” x8”.

These are the current monthly storage fees for standard size products:

- January – September – $0.69/ cubic foot

- October – December – $2.40/ cubic foot

Monthly storage fees for oversize FBA products are as follows:

- January – September – $0.48/ cubic foot

- October – December – $1.20/ cubic foot

However, Amazon charges higher fees for storing products that are deemed “dangerous goods.”

3b – Long-term storage fees

Amazon charges monthly long-term storage fees for inventory items that have been in their fulfillment centers for more than 365 days, in addition to other Amazon fulfillment fees. They currently charge $6.90 per cubic foot or $0.15 per unit, whichever is greater.

Additionally, Amazon conducts an inventory assessment on the 15th of each month.

If you’re selling slow-moving products through FBA, you’ll have to factor in a long-term storage fee to determine if the investment is worth it. Sometimes product returns factor into inventory costs if they don’t become warehouse deals.

How to calculate Amazon long-term storage fees

To calculate long-term storage fees, Amazon starts with determining the number of items at their fulfillment center. Next, they multiply the number of cubic feet in storage by $6.90; and then multiply the amount by the number of items in storage.

For example, let’s assume the number of items at the Amazon fulfillment center is 650, and cubic feet are 10.5 cubic feet. The long-term storage fee is calculated as follows: (10.5 X $6.90) X 650 = $47,092.50.

Other FBA charges to consider

In addition to the fees mentioned above, there are other FBA requirements and FBA charges you must consider. These fees are onehttps://emplicit.co/amazon-fba-fees- reason some sellers compare the pros and cons of FBA vs FBM (fulfillment by merchant).

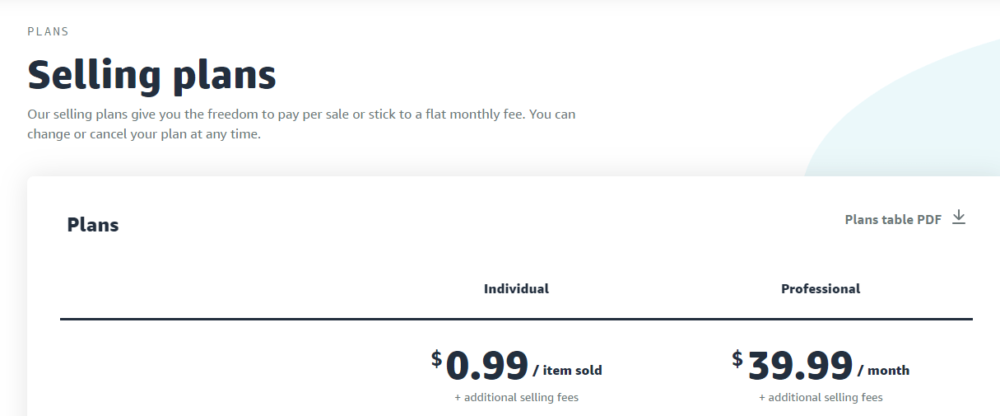

Monthly selling fees

These are the fees that all Amazon sellers pay to sell on the marketplace. It doesn’t matter whether you sell through Amazon FBA, FBM or Seller Fulfilled Prime. Regardless, you’ll be required to pay monthly selling fees.

The amount you pay depends on your selling plan. If you’re selling with an individual selling plan, you’ll pay $0.99 per item sold in addition to referral fees and variable closing fees. But if you sell with a professional selling plan, you’ll pay $39.99 a month in addition to referral fees and variable closing fees. Professional sellers do not pay fees per item.

Returns processing fees

Product returns processing fees apply only to products that are eligible for free returns. This fee is equal to the total fulfillment fee for a given product. That means if the fulfillment fee for a product is $4.28, the returns processing fee is $4.28. But for products without free returns, product returns processing fees are covered in the fulfillment fee.

Penalty fees

Amazon penalizes sellers who do not follow their rules regarding labeling, product prepping, packaging, and other guidelines. If you fail to label or prepare your products according to Amazon’s guidelines, Amazon will slap you with some penalty fees.

Inventory removal fees

Inventory removal fees are charged per item removed from Amazon’s fulfillment centers. The product’s size and weight determine these fees. For standard-size items, they’ll charge you $0.50 per item and $0.60 for oversized items.

Inventory placement service fees

If you want to send your eligible inventory to a single Amazon receive center or fulfillment center through FBA Inventory Placement Service, you’ll be required to pay additional fees. FBA inventory placement service fees vary based on item size and weight.

For standard-size items, inventory placement service fees range from $0.30 to $0.40 per unit, while prices for oversized items range from $1.30 to $1.50.

Photo by Depositphotos

Package preparation fees

If you don’t have the time or resources to prep and package products, Amazon can do it for you at an additional fee. This service comes in handy for sellers who want to avoid the hassle of prepping and packaging products.

FBA export fees

These are fees levied on FBA products exported to multiple countries.

Variable closing fees

These fees are associated with media products such as music, books, DVDs, video games, software & computer, etc. Amazon charges a flat fee between $1.35 and $1.80 for every media product sold. Amazon’s variable closing fees also apply to some non-media products and varies from one category to another.

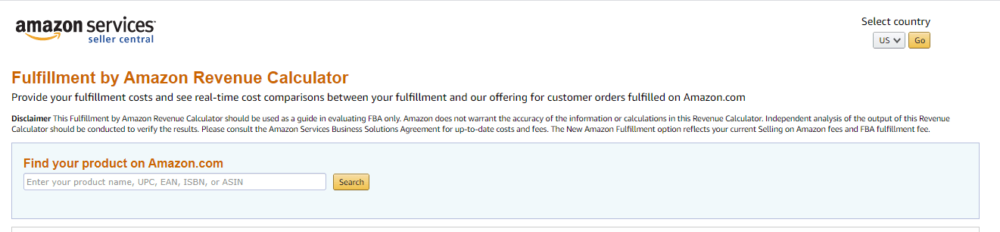

Which tools can you use to determine FBA fees?

The FBA Revenue Calculator is one of the best tools you can use to calculate your Amazon FBA fees. With this calculator, you can input your fulfillment costs to view real-time cost comparisons. The FBA Revenue Calculator allows you to play with different pricing points, shipping costs, and the cost of products.

Apart from helping you decide whether using Amazon FBA is profitable, this calculator can help you select the best products to sell on Amazon.

The Amazon Fee Preview tool on the Manage Inventory page provides users with an estimate of fees. With this tool, you can view anticipated expenses and make an informed decision.

Is FBA right for your ecommerce business?

In general, selling FBA comes with many advantages. With everything from effortless shipping, discounted shipping rates, quick delivery, and hassle-free return management, FBA can be a good investment. But the truth is FBA fees impact your margin, and that’s why it’s essential to choose profitable products to fulfill with FBA.

What works for one seller may not work for another seller, so it’s best to do a thorough cost-benefit analysis before taking the plunge. With lower margins, you need greater sales, and that is where the experts at Emplicit come in. We can help you plan your products, your pricing, and your marketing to fit within your parameters.