Following 2022’s FBA increases including storage, fuel surcharge, and labeling fees, FBA sellers were hit by a double whammy of 2 additional changes in Q4: a holiday peak fulfillment fee and reduced restock limits. These significantly impacted some businesses. However, the reduction in restock limits was just a prelude to a more major change in how FBA sellers manage their inventory at Amazon – the new capacity management system. This article covers what happened during Q4 in 2022, the new capacity manager, and what this all means long term for how FBA sellers approach their inventory strategy.

The holiday peak fulfillment fee

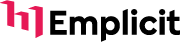

On August 16, 2022, Amazon announced they’d implement a holiday peak fulfillment fee for FBA sellers from October 15th to January 14th. This ranged from an additional $0.21 – $0.52, or an additional 5.3% – 7.9% across various weights of small standard and large standard packages (and more for other package types).

Amazon said this was due to their additional costs of bringing in seasonal warehouse employees and additional transport to handle the increased holiday sales volume. Obviously, Amazon experiences increased operating costs during the holidays, but they do benefit from a significant increase in sales revenue, so this did feel a little unfair. (As did the previous increase in storage fees given that Amazon was claiming to have excess storage space earlier in the year.)

Reductions in restock limits

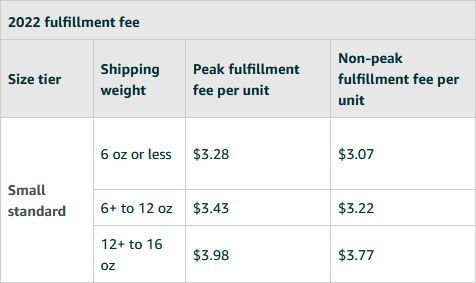

FBA sellers received an email on August 29th confirming Amazon would enforce stricter FBA restock limits in Q4.

The problem was that this appeared to be the only formal communication about the changes. Many sellers were shocked when in October they were hit with massive reductions in their restock limits. Some claimed additional limits were issued on top of their new reduced limits. Indeed, the August 29th email confirmed sellers would retain 4 months of inventory at Amazon, but a late-October email lowered that to 3 months.

Amazon provided its reasoning on Twitter: “To ensure a successful holiday season, we are updating our standard and apparel restock limits to allow all sellers to have 3-4 months of inventory in FBA, including accounting for seasonality and scheduled deals.” Amazon later tweeted that they expect about 6% of sellers to be affected.

We expect about 6% of sellers in the US to be restricted from creating shipments for standard and apparel products. Our records show these sellers have already shipped over three months of inventory, accounting for seasonality and scheduled deals. – Ron (1/2)

— Amazon Seller Help (@amznsellerhelp) October 27, 2022

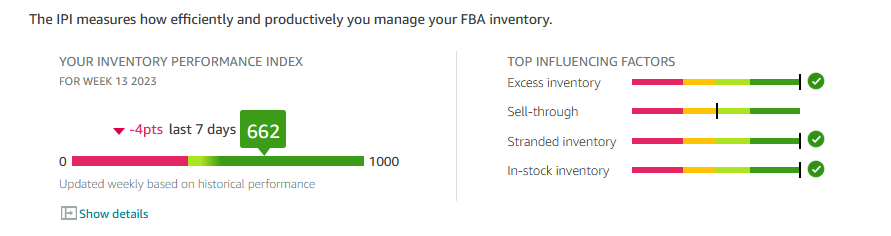

Given the massive backlash, it seemed the automated adjustments were hitting more sellers harder than Amazon claimed. This was likely due to the way the reductions were calculated, i.e. they penalized sellers with already high levels of inventory and lower IPI (Inventory Performance Index) scores. This highlights the need to manage your inventory vs. sales carefully, and not treat Amazon like your personal warehouse.

In Amazon’s defense, although sellers were acting like the reductions in restock limits were unexpected, Amazon also significantly reduced FBA seller storage limits in both Q4 of 2020 and Q4 of 2021.

Looking deeper at the reasons for the restock limit reductions

Amazon never fully explained the reasons for the restock limit reductions. We believe they were likely due to a combination of labor shortages, economic challenges (Amazon downgraded its Q4 forecast), and a desire to shed liabilities on their balance sheets, i.e. reduce their own exposure to excess 1P (1st Party) inventory resulting from over-forecasting throughout the year. The latter is backed up by the experience of many 1P (Vendor Central) sellers who had their Q4 POs from Amazon reduced, some by 25%.

Historically, there is an excess amount of inventory in Amazon fulfillment centers after the holidays. This inventory takes up space while it sells down. Although Amazon collects monthly storage fees, Amazon makes more money from selling products than storage. Additionally, Amazon has to invest in labor resources to manage removal orders and shipping management to send back inventory that sellers want returned, rather than on picking, packing, and shipping customer orders, which generates more revenue.

Of course, it is possible that this decrease in restock limits was simply Amazon preparing for the new capacity management system.

Amazon’s new FBA capacity management system

Amazon is known for constant innovation and evolution. The company’s brand values (their ‘leadership principles’) include “bias for action” and “invent and simplify”, so it’s no surprise the marketplace undergoes rapid change with new programs, products, and algorithms launching regularly. Amazon’s capacity manager, which launched on March 1, 2023, represents possibly the biggest shakeup to FBA since it began in 2006, eclipsing programs like Seller Fulfilled Prime (2016), FBA Onsite (2018), and Buy With Prime (January 2023).

Amazon’s capacity manager in detail

Amazon’s capacity management system is a new methodology for automatically allocating inventory limits to FBA sellers. It’s combined with the ability for sellers to bid on increases to their inventory limits (the additional storage is free if the units sell). Amazon claims it will actually increase most sellers’ capacity limits and give them greater control so they can better plan and manage their supply chain.

There are 6 aspects to the capacity management system.

1 – A single monthly metric for Amazon inventory

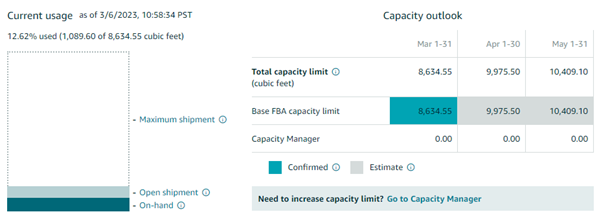

Storage limits and restock limits are replaced with capacity limits, which are a total of inventory already in Amazon fulfillment centers and restock shipments yet to arrive. Capacity limits for the following month are confirmed by Amazon in the third week of the current month.

2 – Estimated capacity limits for 2 months out

As well as the next month’s confirmed capacity limits, Amazon will estimate a seller’s capacity limits for the next 2 months. This will give sellers a 3-month window into how much space they have available, so they can plan the procurement/manufacturing of product.

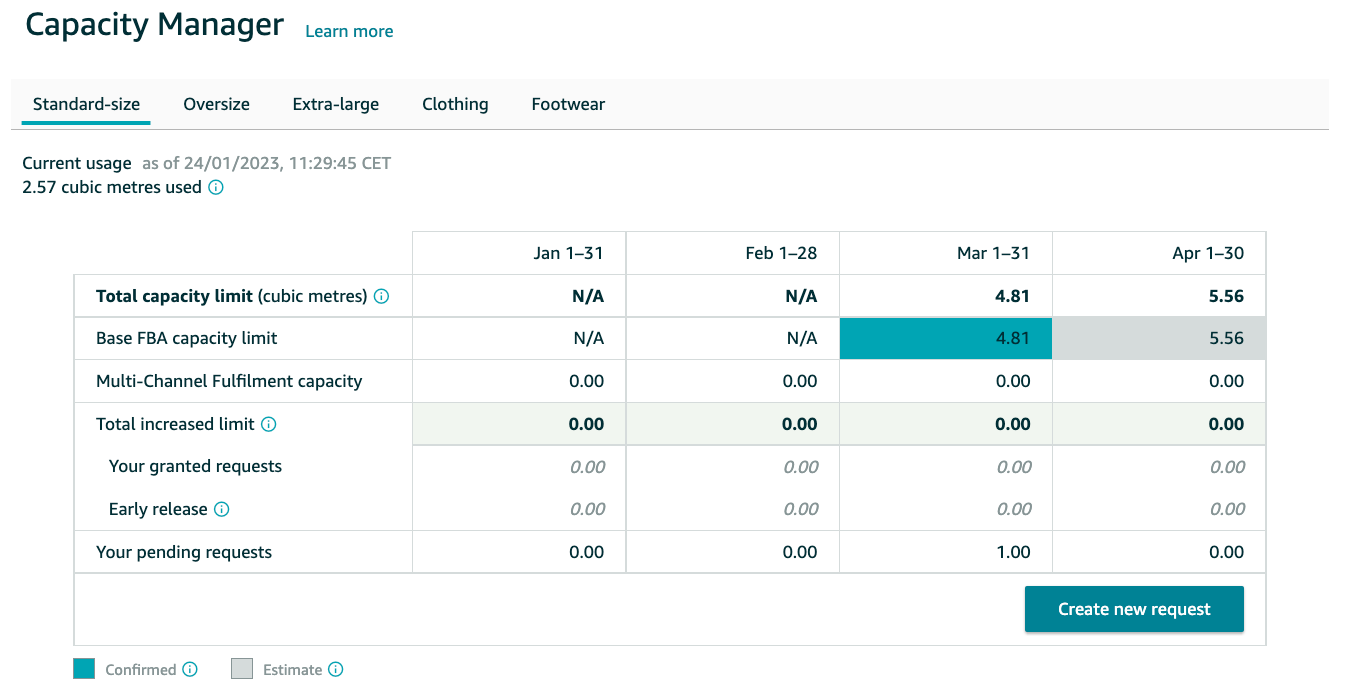

To access the new capacity manager and view confirmed/estimated capacity limits, sellers can go to their FBA dashboard (login required).

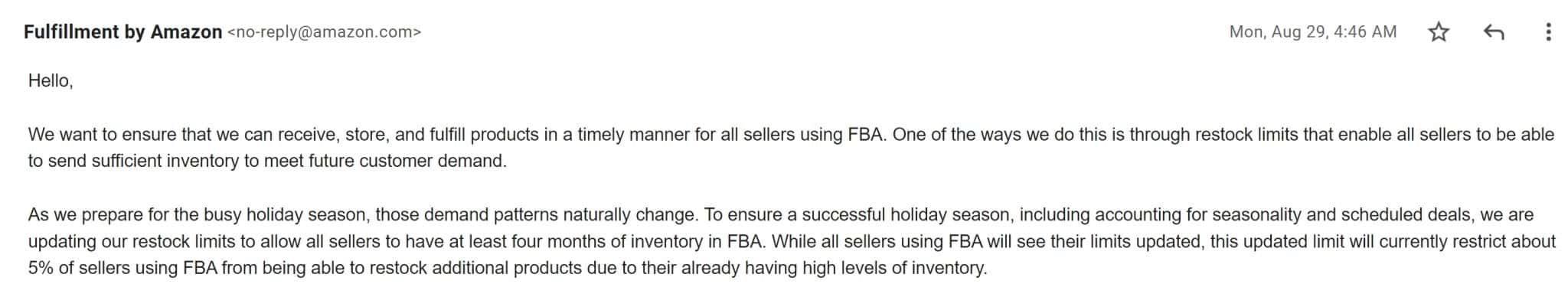

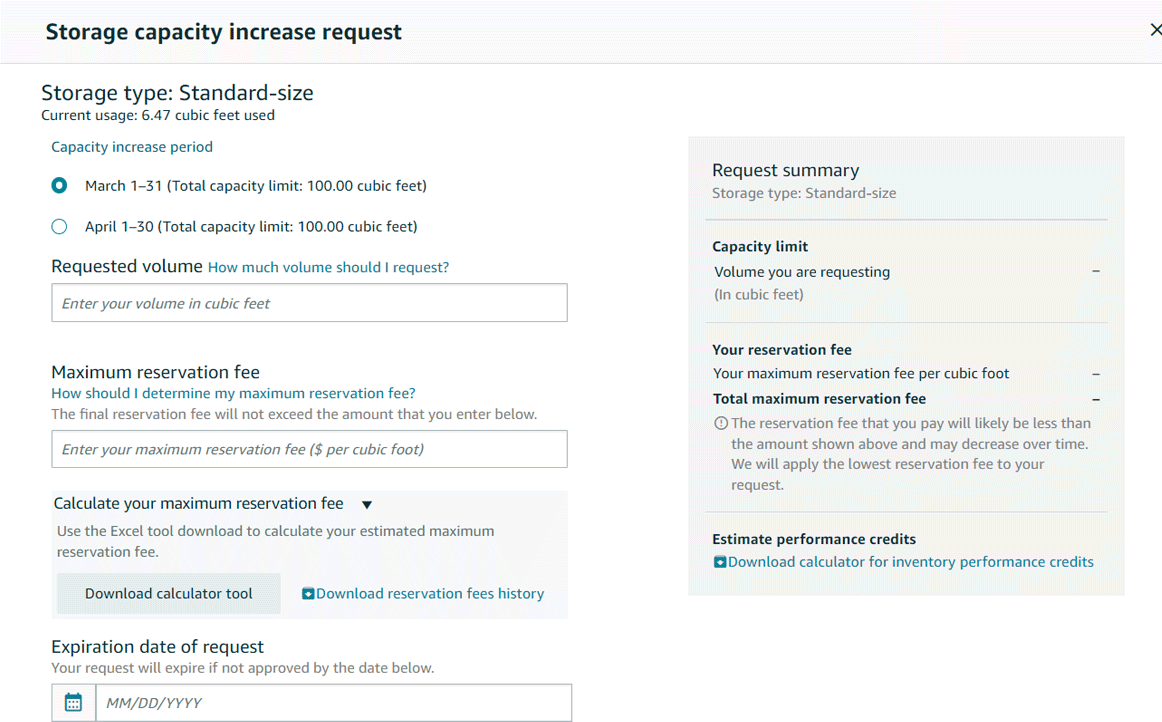

3 – Additional capacity limit bidding

Sellers can request additional capacity of 20% or 2,000 cubic feet (whichever is greater) by bidding on the reservation fee. Amazon grants space to the highest bids per cubic foot. Additional fees are set against ‘performance credits’ from the sales made using the additional capacity, which are earned at $0.15 for every $1 of additional inventory product sold. This means that sellers can recoup 100% of the additional storage fees if they sell the products through. Amazon makes more money from sales than ancillary charges, so this aligns with their objective of encouraging sales above all else.

4 – Capacity limit calculations

Capacity limits are now set based on cubic feet, not number of units, which is the most accurate way to charge for space in fulfillment centers and Amazon trucks. Of course, it does ensure that Amazon is maximizing their return on space, and depending on how bulky a seller’s packaging is, they could end up paying more per unit. This underlines the need for sellers to consider their packaging carefully.

The capacity limit calculation formula is not published by Amazon, but the criteria includes (likely in this order of importance):

- A seller’s IPI score

- Historical sales

- Amazon forecasts of your sales trajectory (which can be hit-and-miss as they are algorithm-based)

- Upcoming seasonal or peak-selling periods

- Scheduled deals

- Merchant shipment lead times (shorter lead times could actually lead to lower capacity limits)

- The relevant fulfillment center’s available capacity (something a seller has no knowledge of or influence over)

5 – Overage fees

Overage fees will still apply if on-hand inventory (not pending restock shipments) exceeds Amazon’s confirmed capacity limits. The overages, charged by the cubic foot, are dynamic based on Amazon’s highest estimated limit and how many days you exceed your capacity limits. These fees occur even if your inventory is subsequently reduced to below your allocated capacity limits. They will be charged monthly at $10 per cubic foot based on the daily average volume for any space your inventory occupies beyond your capacity limits.

This is not cheap and underlines the need to remain vigilant managing inventory. The good news is that sellers still receive inventory information in units so they can calculate their remaining stock, because few sellers use cubic feet for their own inventory tracking.

6 – Limits for new seller accounts

For brands that have been selling less than 39 weeks, Amazon says there are no FBA capacity limits. The purpose of this is to allow Amazon (and merchants) to establish FBA sales records, i.e. benchmarks to base future capacity limits on.

This might tempt new sellers to front-load as much inventory as they can, but they should focus on sales and metrics that drive IPI scores. This will result in more available capacity long term and avoid overage fees.

Benefits of Amazon’s new FBA capacity management system

The main benefit for FBA sellers is the ability to increase storage limits to satisfy upcoming peaks in demand. Sellers can now do this without having to build a case based on upcoming deals, promotions, or media spend, with their seller support agent or Amazon rep. Previously, this was time consuming, not guaranteed, and the actual increases awarded were unpredictable.

For sellers who suffered from the reduction in restock limits, if they manage to sell-through their additional inventory, a major benefit is they won’t need to pay for the additional capacity. The more you drive sales, the cheaper it becomes to support them.

The single measure of capacity by cubic feet seems like a disadvantage because sellers have traditionally thought in terms of number of units. However, this should actually enable FBA sellers to fit more units per cubic foot and reduce their shipping costs, as they’re forced to think more strategically about the size of their packaging.

Lastly, despite the uncertainty about the new capacity limits, we concur with Amazon that this can benefit sellers. The vast majority of our clients have seen an increase in capacity, especially newer accounts that traditionally had lower restock limits. Of course, not every seller can benefit without Amazon increasing its storage. We suspect those not benefiting will be sellers with slow-moving inventory and/or paying long-term storage fees.

How best to use the capacity management system

Sellers will have to see what bids for additional capacity end up ‘winning’, given Amazon awards requests to the highest bidder first. Rapid trial and error will enable sellers to know what they’ll pay for additional storage, and whether they can recoup the fees through performance credits.

Of course, in challenging Amazon’s new capacity limits, by bidding for more, sellers will have to follow through and sell the additional inventory. We can see a situation where, on top of the cost of additional capacity and overage fees, if a seller doesn’t sell the additional inventory, Amazon may in fact penalize them by reducing their IPI. One would hope the opposite is true and Amazon increases a seller’s IPI if they regularly sell all their additional inventory.

As mentioned above, sellers who focus on reducing packaging size will be able to squeeze more units in the same cubic feet, as well as significantly reducing their shipping fees. For example, sellers can save $0.50 to $1 or more by dropping products in Amazon’s Small and Light program.

Outstanding questions about the capacity management system

A few questions we’ll resolve as we identify how our clients can benefit from the capacity manager are:

- Will Amazon reduce seller’s allocated capacity limits as a sneaky way to encourage sellers to pay for more?

- Will Amazon increase or decrease seller’s IPI scores based on whether they do or don’t sell any additional inventory?

- What happens when Amazon starts to run out of additional storage space to purchase at peak times or due to Buy With Prime pressure?

- What happens to reservation fees if Amazon doesn’t conduct an inventory check-in or takes a product down in error?

How Emplicit can help clients benefit from Amazon’s capacity manager

Despite being revolutionary for FBA sellers, the new capacity manager program’s performance is still primarily driven by sales. Sellers who sell more inventory and avoid slow-moving products and excess inventory will be the ones with higher base capacity limits. In contrast, it will cost sellers who overstocked due to lower fees approximately 10% more to hold inventory month-to-month, and 200%+ more to manage inventory disposal/removal.

Amazon’s capacity manager represents a great opportunity to work with Emplicit to reevaluate your products on Amazon, analyze your profitability, and strategically look at how you can continue being a successful Amazon seller. Emplicit specializes in combining efficient inventory strategies with effective sales strategies to ensure clients continue winning on Amazon.