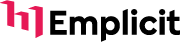

Amazon’s Subscribe & Save isn’t just a convenience tool – it’s a game-changing revenue driver for pet brands when used strategically. Over half of dog food revenue (58%) comes from subscriptions, and subscribers are three times more valuable than one-time buyers. Yet many brands fail to maximize its potential by treating it as a simple feature rather than a focused strategy.

Key Takeaways:

- Pet products like food, litter, and supplements are ideal for subscriptions due to predictable usage patterns.

- Subscribers have a 51% higher lifetime value than regular customers and boost repeat purchases by 20%-30%.

- Amazon rewards strong subscription performance with better search rankings and organic visibility.

- Discounts between 5%-10% drive conversions without sacrificing profitability, while bundling products increases order value.

- Inventory management is critical – stockouts can lead to canceled subscriptions and lost customers.

To succeed, brands must actively manage discounts, optimize product offerings, and track performance metrics like retention rates and lifetime value. Treating Subscribe & Save as a strategic channel can transform how your brand generates loyalty and recurring revenue.

Amazon Subscribe & Save Key Statistics for Pet Brands

Ep11: Subscribe & Save Growth Hacks 🎙️ Amazon FBA

sbb-itb-e2944f4

How Amazon Subscribe & Save Works for Pet Brands

Amazon’s Subscribe & Save program allows customers to set up scheduled deliveries – weekly, monthly, or at other intervals. For pet brands, this feature provides a steady stream of recurring revenue. Subscribers can save up to 15% when purchasing in bulk. There are no additional fees beyond the usual Fulfillment by Amazon (FBA) and selling costs, but a Professional Selling account ($39.99/month) is required to participate.

Pet owners benefit from having essential items delivered on time, without hassle. This convenience also helps reduce advertising expenses and improves organic search rankings, as products with strong subscription performance often rank higher on Amazon.

Here’s what your pet brand needs to qualify for this program.

What Pet Brands Need to Qualify

To take advantage of Subscribe & Save, pet brands must meet Amazon’s specific criteria:

| Requirement | Detail |

|---|---|

| Fulfillment Method | Products must be fulfilled through FBA for automatic enrollment. FBM sellers must request manual enrollment. |

| Brand Status | Enrollment in Amazon Brand Registry and designation as a Brand Representative are required. |

| Account Type | A Professional Selling Plan is mandatory. |

| Performance Metrics | Sellers need high in-stock rates (typically 85% or higher), reliable fulfillment history, and strong feedback (often above 4.7). |

| Product Category | Products must be replenishable. Pet Supplies is an approved category. |

Maintaining an in-stock rate of at least 85% is critical. If your inventory runs out, Amazon cancels pending subscriptions, making it unlikely customers will return. Sellers are also expected to have at least three months of FBA selling history as proof of consistent performance.

Choosing the Right Pet Products

Not all pet products are suitable for Subscribe & Save. Items that are consumed regularly – like dog food, cat litter, waste bags, or supplements in 30-, 60-, or 90-day supplies – are ideal because they naturally require frequent replenishment. On the other hand, durable goods like pet beds or toys are less suitable since they don’t need to be replaced often.

Dog food has the highest subscription rate, with 58% of customers opting for this option, followed by cat food at 45.9%. These products are often bulky and inconvenient to carry, making home delivery especially appealing. Pet supplements also perform well as they’re often part of a pet’s daily care routine.

"Pet products are uniquely suited for Amazon’s Subscribe & Save program because they combine necessity, frequency, and convenience." – Denny Smolinski, beBOLD

However, some items – like CBD products and restricted supplements – are prohibited from the program. Make sure to stick to approved consumables to avoid eligibility issues.

How to Enable Subscribe & Save

If you’re using FBA, Amazon often auto-enrolls eligible products with a starting discount of 0%. You can increase this to 5% or 10% to encourage more subscriptions. To manage this, log in to Seller Central and go to Settings > Fulfillment by Amazon > Subscription Settings. From there, select the SKUs you want to include and set your desired discount level.

For products not auto-enrolled, download the inventory file template from the Add or Remove Subscribe & Save Products page. Fill it out with your SKU, select "Enable", choose a discount level, and upload it as a .txt file. If you’re not using FBA, you’ll need to contact Seller Support at fba-sns-help@amazon.com or fba-sns-feedback@amazon.com to request enrollment, provided you meet Amazon’s strict delivery performance requirements.

Once your products are enrolled, check your Subscribe & Save Performance Report in Seller Central regularly. This report provides insights into forecasted demand, missed deliveries due to stockouts, and subscription retention rates. Use this data to adjust inventory levels and optimize your strategy. Offering a 10% discount can increase conversions by up to 1.8x compared to no discount. Carefully calculate your margins to ensure profitability, and keep refining your inventory and pricing strategies for success.

Why Most Pet Brands Fail at Subscribe & Save

Many pet brands activate Subscribe & Save but fail to take the necessary steps to maximize its potential, leaving a valuable revenue stream underutilized. Treating it as just another feature rather than a strategic channel often leads to missed opportunities and limited growth. Let’s break down the common mistakes and how brands can fix them.

Treating It as a Set-It-and-Forget-It Feature

Amazon automatically enrolls eligible products into Subscribe & Save with a 0% discount. This convenience often gives brands a false sense of accomplishment – they assume the setup is complete and skip essential steps like adjusting discounts, refining product listings, or actively promoting subscriptions. This hands-off approach stifles growth before it even has a chance to take off.

The real value of Subscribe & Save emerges after customers reorder multiple times. Brands that fail to optimize their listings with clear messaging – such as “never run out,” feeding charts, or lifestyle imagery – miss out on boosting their revenue potential.

"The subscription economy isn’t dead, it’s just evolved. Brands that recognize Amazon Subscribe & Save as a strategic channel rather than a reluctant concession will capture the customers who are increasingly choosing convenience over brand loyalty."

- Tristan Williams, Author, Envision Horizons

Overlooking Products Beyond Food and Treats

While food is a natural fit for subscriptions – dog food has a 58% subscription rate, and cat food follows at 45.9% – many brands stop there. This narrow focus leaves other high-demand consumables untapped. Products like cat litter, waste bags, grooming wipes, supplements, and even replacement parts for pet fountains or grooming tools are often overlooked.

Expanding beyond food allows brands to capture recurring purchases across the broader pet care category. In fact, when the right products are enrolled, subscriptions can account for 28% of total revenue in the pet supplies sector.

Using Weak Discount Structures

Another common pitfall is poorly designed discount strategies. Some brands offer a modest 5% discount but see little impact on subscriptions, while others go too far, offering discounts above 20%, which can lead to immediate cancellations. Both approaches fail to strike the balance between conversion growth and profitability.

For instance, a 10% discount can increase subscription conversion rates by up to 1.8x compared to no discount at all. Additionally, subscribing to five or more products unlocks an extra 5% discount funded by Amazon, totaling 15% savings for the customer. Brands that ignore this balance either lose potential subscribers or sacrifice their margins to an unsustainable degree.

| Discount Level | Best For | Expected Subscription Rate | Margin Impact |

|---|---|---|---|

| 5%–7% | Premium brands, high-margin products | 15%–20% | Low |

| 8%–12% | Competitive categories, everyday essentials | 25%–35% | Moderate |

| 13%–15% | Market penetration, new product launches | 35%–45% | High |

Source: Netpeak Agency Strategy Guide

Another misstep is offering pack sizes that don’t align with typical consumption habits. A 15-day supply forces customers to reorder too often, while a 120-day supply can lead to overstocking and cancellations. To avoid this, brands should offer 30-, 60-, and 90-day supplies that better match real-world pet care routines.

How to Turn Subscribe & Save into a Revenue Driver

Many pet brands activate Subscribe & Save without a clear strategy in mind. But the ones that truly see growth treat it as a dedicated marketing channel. They combine smart pricing, thoughtful bundling, and targeted advertising to drive revenue and customer loyalty.

Pricing Models That Deliver Results

A good starting point is a 10% total discount: split evenly between 5% seller-funded and 5% Amazon-funded (available when customers subscribe to five or more items). This balance encourages conversions while protecting your margins. For example, in 2025, the supplement brand Dose, led by Lindsay North, implemented this structure. The result? Subscribers had a 51% higher lifetime value than one-time buyers, and reorder rates doubled after rolling out the program.

For first-time subscribers, offering vendor-powered coupons with discounts between 15% and 40% on the initial order can be a game changer. One pet brand studied by Envision Horizons in 2025 used a 20% first-order discount, followed by a 10% ongoing discount. This approach generated 36% of total Amazon revenue through subscriptions and achieved a 73% retention rate within 90 days.

However, avoid extremes. Discounts under 5% often fail to attract interest, while anything over 20% risks drawing in customers who cancel after their first order.

"Subscribe & Save customers are worth three times more than regular one-time purchase customers, and often cost less to acquire than DTC subscribers."

- Tristan Williams, Envision Horizons

Product Bundling and Cross-Selling

Smart bundling strategies can amplify the value of subscriptions. Pair your best-selling product – like dry dog food – with complementary items such as treats, supplements, or grooming wipes. This not only increases the average order value but also helps customers reach Amazon’s five-item threshold for an additional 5% discount.

In early 2025, Shopify agency Cross Digital implemented a tailored bundling approach for three pet food brands: Basil’s Raw Dog Food, Top Dog Food & Supply, and The Farmer’s Dog (UK). Using the Easy Bundle Builder app, they offered optimized box sizes (16, 24, or 32 units) with a 10% subscription discount. The initiative generated $1.1 million in bundle revenue, with The Farmer’s Dog (UK) alone contributing $814,664.

| Strategy | Pros | Cons |

|---|---|---|

| Pre-set Bundles | Simplifies decision-making; optimizes shipping weight | Less personalized; may include unwanted items |

| Build-Your-Own Box | High engagement; allows flavor/variety rotation | More complex to implement; requires inventory syncing |

| Cross-Sell Add-ons | Boosts AOV; introduces high-margin accessories | Risk of subscription fatigue if costs climb too high |

Cross-selling is also a smart way to move slower inventory. For example, bundle trial-sized new products with best-sellers to encourage discovery without launching separate campaigns. Target staple product subscribers – like kibble buyers – with high-margin add-ons such as dental chews or joint supplements. These tactics not only increase lifetime value but also address specific pet care needs.

Using PPC to Grow Subscriptions

Paid advertising can bridge the gap between one-time buyers and long-term subscribers. Sponsored Display ads with purchase remarketing are particularly effective. By setting a lookback window of 7 to 365 days, you can target customers at the right moment when they’re likely to reorder.

For an even more tailored approach, leverage DSP (Demand-Side Platform) campaigns. Tools like Dynamic eCommerce (DEA) and Responsive eCommerce Creatives (REC) showcase your Subscribe & Save discount directly within the ad. This makes the value clear before the customer even clicks.

"We retarget shoppers that have previously purchased our products with a creative that highlights the Subscribe & Save deal. We can use the ‘Shop Now’ variation of Dynamic eCommerce (DEA) and Responsive eCommerce Creatives (REC), which shows the discount within the ad units."

- Emma Rickus, Programmatic Media Strategist, Code3

Targeting long-tail keywords like "dog food monthly delivery" or "cat litter subscription" can also attract high-intent shoppers already considering recurring orders. Protect your branded search terms with Sponsored Brands campaigns to prevent competitors from snatching your loyal customers.

Finally, use Amazon Marketing Cloud (AMC) to build lookalike audiences based on your existing high-value subscribers. A case study from the beauty industry showed AMC lookalike audiences delivered 3x to 5x higher ROAS compared to conquesting campaigns. Make sure to exclude current subscribers from your campaigns to focus your ad spend on acquiring new customers or converting one-time buyers.

Tracking Performance and Results

The first step to improving your Subscribe & Save strategy is understanding how it performs. Measurement is the key to turning this feature from a passive offering into a deliberate revenue generator. Amazon provides two primary reports in Seller Central to help sellers get started: the Subscribe & Save Forecasting report, which predicts demand for the next eight weeks, and the Subscribe & Save Performance report, which breaks down historical weekly data. These reports give insights into active subscribers, scheduled units, and ASIN-level revenue – critical details for identifying consistent revenue streams.

However, these standard reports only go so far. To dig deeper into metrics like organic Subscribe & Save conversions, replenishment frequency, and long-term subscriber retention, you’ll need Amazon Marketing Cloud (AMC). AMC is the only tool that can calculate subscriber lifetime value (LTV) and track how long customers stick with their subscriptions. For example, data shows that dog food subscriptions boast a retention rate of nearly 58%, and subscribers are three times more valuable than one-time buyers. This highlights why precise tracking is essential.

"Subscribe & Save is vital for your profitability calculations, your upselling strategy, and even your customer loyalty analysis."

- Michael Waters, Intentwise

Once you’ve gathered the data, the next step is focusing on the metrics that directly shape your recurring revenue.

Metrics That Matter

To build a successful Subscribe & Save strategy, keep a close eye on these key metrics: active subscriptions, shipped revenue, and subscriber lifetime value (LTV). Active subscriptions reveal how many customers are committed to recurring orders for each SKU. Shipped revenue reflects the actual income generated from fulfilled subscription orders, not just what’s scheduled. And LTV, accessible through AMC, helps determine whether your subscribers stick around long enough to make their acquisition costs worthwhile.

Another critical metric is your out-of-stock rate. Inventory issues can lead to missed deliveries, which often result in immediate cancellations and lost customers. Additionally, pay attention to the "second order" metric.

"The second order is your turning point, this is where loyalty starts to compound and where you should focus your retention efforts."

- Tristan Williams, Envision Horizons

Retention benchmarks for healthy subscription programs are typically around 90% after 30 days and 75% after 90 days.

Here’s a quick overview of essential metrics and where to find them:

| Metric | What It Tells You | Where to Find It |

|---|---|---|

| Active Subscriptions | Total uncancelled subscriptions per SKU | Forecasting Report |

| Scheduled Units | Items queued for delivery in the next 8 weeks | Forecasting Report |

| SnS Shipped Revenue | Actual revenue from subscription orders | Performance Report |

| Subscriber LTV | Total value of a customer over their subscription lifespan | AMC (Paid Data Set) |

| Out-of-Stock Rate | Percentage of missed orders due to inventory issues | Performance Report |

Also, monitor New-To-Brand (NTB) subscribers using the Brand Metrics dashboard. This metric shows how many customers start subscribing after their first purchase versus after multiple one-time buys. A high NTB share suggests your initial offers are effective, while a lower share might indicate a need to improve your first-order incentives.

Once you’ve nailed down these metrics, the next challenge is ensuring smooth operations through accurate forecasting.

Forecasting and Inventory Management

The 8-week Forecasting Report provides a week-by-week breakdown of scheduled units, giving you a detailed view of your upcoming fulfillment needs. This report is crucial because Amazon notifies customers about upcoming deliveries, and stockouts can trigger "missed delivery" alerts that might push customers to competitors.

One useful field in this report is the "estimated-avg-sns-discount-next-8-weeks", which helps you account for margin changes and fine-tune your unit economics before scaling ad spend.

To optimize inventory, align your product pack sizes with actual consumption patterns. For example, offering 30-, 60-, or 90-day supply packs that match how quickly pets consume food, treats, or supplements can prevent customers from running out too soon (leading to cancellations) or stockpiling excess inventory that distorts your forecasting data.

Maintain a buffer stock to avoid gaps using tools like Inventory Lab or Restock Reports. With about 35% of Amazon shoppers having subscribed to a product at least once, and subscriptions accounting for 28% of revenue in the pet supplies category, the stakes are too high to risk missing deliveries.

Pet Brands That Got Subscribe & Save Right

Using Subscribe & Save effectively can turn a simple feature into a serious revenue driver. While many pet brands activate it without much thought, a few have mastered the art of turning one-time buyers into loyal subscribers.

Attracting New Customers with Tiered Discounts

Merrick Pet Care aimed to win over pet owners who were buying from competitors. In 2020, they launched a campaign specifically targeting these shoppers. By combining TV ads with display remarketing, they honed in on this audience and managed to generate over one-third of their Subscribe & Save customers. The result? A 475% surge in new-to-brand purchases.

Their secret weapon was a tiered discount system: a 15% total discount, split between 10% seller-funded and an extra 5% for orders of five or more items. This strategy didn’t just boost conversions – rates were up to 1.8× higher – but also increased subscriber lifetime value (LTV) by 20% compared to one-time purchases.

"By increasing their new-to-brand customers, they’d have a greater opportunity to drive loyalty and repeat purchase."

- Amazon Internal/Merrick Case Study

Once new customers are on board, keeping them engaged becomes the next big challenge. That’s where bundling comes in.

Boosting Retention with Product Bundles

Getting new subscribers is great, but keeping them is where the real value lies. HawaiiPharm, a pet supplement brand, tapped into the growing wellness market by creating smart product bundles. Between 2024 and 2025, they saw over 700% growth compared to market leaders and grew their share of the dog supplement market by 240%. Their approach? Pairing complementary products like joint supplements with digestive health formulas. These bundles encouraged customers to hit the five-item threshold for maximum discounts.

Bundling doesn’t just increase the average order value – it also aligns with natural usage patterns, like 30-, 60-, or 90-day cycles, making subscriptions more appealing. Hartz used a similar strategy in the cat treats category. By introducing multi-packs and variety bundles, they made recurring orders irresistible. This approach led to a 450% jump in revenue and a 127% boost in market share.

These examples show how thoughtful strategies can make Subscribe & Save a game-changer for pet brands, turning casual buyers into loyal, long-term subscribers.

Conclusion

Amazon Subscribe & Save isn’t just a feature to check off – it demands active management to truly maximize its revenue potential. Pet brands that treat it passively risk missing out on recurring income, while those that approach it with a clear strategy can see repeat purchase rates jump by 20% to 30%.

To make the most of this program, execution matters. Offer discounts in the range of 5% to 10% to drive conversions, ensure pack sizes align with typical consumption cycles to streamline inventory, and use bundling to help customers hit the threshold for Amazon’s co-funded discounts. Keep a close eye on retention rates at 30 and 90 days, and avoid stockouts at all costs – they can be deal-breakers for subscriptions.

"The question isn’t whether you can afford to invest in Amazon Subscribe & Save, it’s whether you can afford not to!"

- Tristan Williams, Envision Horizons

The pet category is booming, growing 25.3% year-over-year, with dog food alone accounting for 58% of its revenue through subscriptions. This trend shows how today’s pet owners prioritize convenience, consistency, and the peace of mind that comes with always having what they need on hand.

If Subscribe & Save is treated as just another discount tool, you’re leaving money on the table. Instead, focus on modeling your margins, optimizing your product catalog, and building a subscription base that grows over time. The top-performing brands on Amazon aren’t just selling – they’re securing recurring revenue and turning one-time buyers into loyal, long-term customers.

FAQs

What are the best strategies for pet brands to succeed with Amazon’s Subscribe & Save program?

Pet brands can use Amazon’s Subscribe & Save program to build customer loyalty and boost recurring revenue. To start, consider offering well-thought-out discounts. For instance, you might provide a base discount between 0% and 10%, with additional savings for customers who commit to higher subscription tiers. Another effective strategy is bundling related products, which can encourage larger purchases. Make sure your package sizes match typical consumption rates to add convenience for your customers.

Highlight the perks of subscribing with engaging A+ content. Focus on benefits like saving money and the ease of automatic reordering. Keep an eye on key metrics such as customer retention and lifetime value (LTV) to fine-tune your strategy as you go. Also, prioritize managing inventory and promotions carefully to ensure your subscribers always enjoy consistent pricing and product availability. This seamless experience can help turn one-time buyers into loyal, long-term customers.

What do pet brands need to qualify for Amazon’s Subscribe & Save program?

To join Amazon’s Subscribe & Save program, pet brands need to meet specific criteria. Products must belong to approved categories, typically consumables that customers purchase regularly – like pet food, treats, litter, grooming supplies, or supplements. Additionally, each product must be enrolled via Seller Central and pass Amazon’s eligibility checks.

Brands must also set a base discount of 0%, 5%, or 10%. To enhance customer appeal, they can offer an extra 5% discount for subscribers who order five or more items in one shipment. Maintaining consistent inventory levels – often managed through Fulfillment by Amazon – and providing clear, compliant product listings with accurate subscription options are key requirements.

By meeting these standards, pet brands can tap into recurring revenue streams, boost conversion rates, and strengthen customer loyalty through the ease of subscription purchases.

Why do many pet brands struggle to make the most of Amazon’s Subscribe & Save program?

Many pet brands fail to unlock the full potential of Amazon’s Subscribe & Save program because they treat it as just another feature instead of a powerful growth tool. Often, they stick with default discount settings, assuming subscriptions will naturally grow over time. But without fine-tuning elements like pricing, pack sizes, or bundling, they miss out on opportunities to encourage customers to hit the five-item discount tier. For example, aligning product quantities with typical pet consumption patterns or offering targeted promotions could lead to higher-value subscriptions.

Another misstep is focusing solely on getting customers to sign up, while neglecting the importance of keeping them engaged over the long term. The real strength of Subscribe & Save is in building loyalty through repeat refills, which boosts customer lifetime value. Brands that overlook retention metrics, fail to adjust discounts based on repeat behavior, or ignore the importance of refining replenishment intervals often struggle with high churn rates. This results in missed chances for steady, recurring revenue. By leveraging data and adopting a more strategic approach, pet brands can transform Subscribe & Save into a dependable revenue generator instead of leaving it underutilized.

Related Blog Posts

- Why 73% of Pet Brands Fail on Amazon Before Year Two (And How to Be the Exception)

- How to Turn One-Time Pet Buyers Into Subscribers Who Reorder for Years

- The Humanization of Pet Care Is Changing Amazon. Is Your Brand Keeping Up?

- Why the Fastest-Growing Pet Brands on Amazon Are Spending Less on Ads, Not More