Want to know which pet brands will still be around in three years? Look at their Subscribe & Save performance on Amazon.

Here’s why this matters:

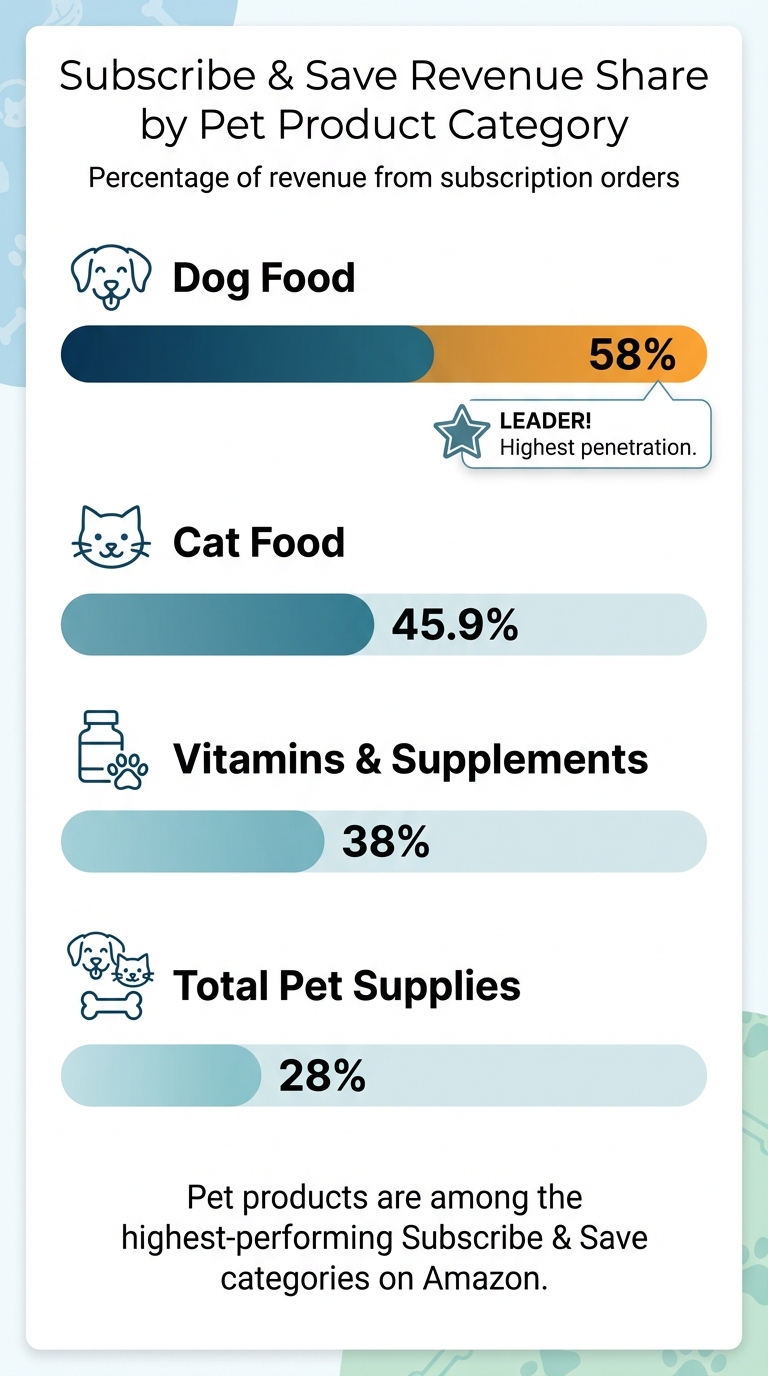

- 58% of dog food revenue on Amazon comes from subscriptions. For cat food, it’s 45.9%.

- Customers using Subscribe & Save are worth 3x more than one-time buyers and spend 13% more overall.

- Subscriptions lower advertising costs, stabilize revenue, and help brands plan inventory better.

Brands that fail to prioritize subscriptions often face higher costs, stockouts, and shrinking market share. Meanwhile, those leveraging Amazon’s Subscribe & Save program lock in loyal, repeat customers and build predictable revenue streams.

The takeaway? If a pet brand isn’t focusing on subscription adoption and retention, it’s likely falling behind competitors.

The Real Way to Grow Subscribe & Save on Amazon

sbb-itb-e2944f4

What Subscribe & Save Is and Why Pet Brands Need It

Subscribe & Save Revenue Share by Pet Product Category on Amazon

How Subscribe & Save Works on Amazon

Amazon’s Subscribe & Save program is a subscription service that allows customers to set up recurring deliveries for products they use frequently. Shoppers can choose how often they want their items delivered – monthly, every other month, or even less frequently – and Amazon takes care of the rest. Deliveries are automatic, shipping is free, and customers enjoy a discount on their purchases.

Sellers participating in the program provide a base discount, which can be 0%, 5%, or 10%. On top of that, Amazon offers an additional 5% discount when customers order five or more products in a single delivery. This means subscribers can save up to 15% in total on their recurring orders.

To offer Subscribe & Save, brands need to be enrolled in Amazon Brand Registry and typically rely on Fulfillment by Amazon (FBA). Once set up, the program helps sellers establish a steady revenue stream, making it easier to predict inventory needs based on active subscriptions. Customers benefit too – they receive reminders before shipments, and they can skip or cancel deliveries without any penalties.

This seamless system is particularly well-suited for pet products, where regularity and convenience are key.

Why Pet Products Work Well with Subscribe & Save

Pet products are a natural fit for the Subscribe & Save program because they align perfectly with the recurring nature of pet care.

Pet owners often purchase essentials like food, litter, and waste bags on a predictable schedule. For instance, a 30-pound bag of dog food might last about a month, making automatic deliveries a practical solution. The convenience is even more appealing for bulky items – carrying a 40-pound bag of dog food or a large pack of cat litter from the store can be a hassle, but home delivery eliminates that problem entirely.

The regularity of pet care translates into strong subscription performance. For example, dog food generates 58% of its revenue through subscriptions – the highest rate in any Amazon category. Cat food follows closely with a 45.9% subscription rate, while pet supplements, which require consistent daily use, achieve a 38% subscription rate.

| Pet Product Category | Subscribe & Save Revenue Share |

|---|---|

| Dog Food | 58% |

| Cat Food | 45.9% |

| Vitamins & Supplements | 38% |

| Total Pet Supplies | 28% |

Products offering the maximum 10%–15% discount often see conversion rates increase by up to 1.8x. Additionally, sellers report that repeat purchase rates through Subscribe & Save are 20% to 30% higher compared to one-time buyers. By combining predictable demand, meaningful savings, and hassle-free delivery, Subscribe & Save has become a game-changer for pet brands looking to build long-term success.

How Subscribe & Save Affects Pet Brand Survival

Subscribe & Save has become a game-changer for pet brands – it can mean the difference between thriving in the market and fading into obscurity. Take dog food, for example: a whopping 58% of its revenue comes from subscriptions. Ignoring this trend is like leaving piles of cash on the table.

But it’s not just about boosting immediate sales. High Subscribe & Save adoption gives brands a steady stream of recurring revenue. This makes it easier to predict inventory needs, avoid stockouts, and keep operations running smoothly. Subscribers reorder automatically, cutting out the need for constant advertising spend. On the flip side, brands with low subscription rates are stuck in an endless loop of retargeting campaigns. The predictability of subscription revenue doesn’t just stabilize a brand – it strengthens its position in the market.

"Consumers are not using the Amazon marketplace as a search and discovery platform for pet food. If companies want to make customers switch to their own brand, they need to convince them outside of Amazon."

– Emily Hunt, Market Research & eCommerce Specialist

Here’s the kicker: once a pet owner subscribes to a brand for their dog’s food, they’re unlikely to shop around. Amazon essentially shifts from being a discovery platform to a replenishment tool, locking in that customer for the long haul. And there’s more – Subscribe & Save customers spend 13% more than those who don’t subscribe. Brands that master subscription models aren’t just surviving; they’re setting themselves up for long-term success. Those that don’t? They risk being left behind.

Case Study: How High Subscribe & Save Adoption Drives Growth

Real-world examples highlight how powerful this model can be. In 2025, the supplement brand Dose introduced a 10% ongoing discount tailored to Amazon shoppers’ habits. The results? A 51% jump in lifetime value (LTV) for Subscribe & Save customers and a doubling of reorder rates in just a few months.

"We realized that Amazon customers and DTC customers can be both very similar, but also vastly different with the subscription model."

– Lindsay North, Head of Amazon, Dose

The pet supplement market tells a similar story. HawaiiPharm, for instance, saw explosive growth – over 700% – by fully embracing Subscribe & Save. In 2024, the brand increased its dog supplement market share by 240%. Another pet brand took a strategic approach in 2025, offering a 20% first-time subscription discount paired with a 10% ongoing discount. This strategy led to subscriptions driving 36% of the brand’s total Amazon revenue and achieving a 73% retention rate within 90 days.

What Brands with Low Subscribe & Save Engagement Have in Common

Brands that struggle with Subscribe & Save often face predictable hurdles. The biggest? Sky-high customer acquisition costs. Without subscriptions, every repeat purchase demands the same level of marketing spend as the first, making it nearly impossible to scale profitably. And the numbers don’t lie – non-subscribers are typically worth only a third of a subscriber’s lifetime value. Without this strategic edge, these brands find themselves grappling with rising costs and shrinking market relevance.

Inventory issues also plague brands without strong subscription models. Without reliable data from subscriptions, forecasting becomes a guessing game. Stockouts and missed deliveries erode customer trust, leading to cancellations. While Subscribe & Save doesn’t directly guarantee winning the Buy Box, the operational consistency it requires – like maintaining inventory and competitive pricing – plays a big role in achieving that coveted visibility on Amazon.

The most alarming challenge? Losing market share. In categories like pet food, where subscriptions dominate, customers are bypassing traditional discovery paths in favor of automated reorders. As competitors lock in these recurring buyers, brands without robust subscription strategies are left fighting over a dwindling pool of one-time shoppers.

How to Track and Improve Your Subscribe & Save Performance

Recurring revenue is a game-changer for sellers, and making the most of Subscribe & Save requires careful tracking. Thankfully, Amazon Seller Central offers detailed reports to help you monitor performance. The Subscribe & Save Performance Report provides insights into weekly orders, out-of-stock rates, and average sale prices. Meanwhile, the Subscribe & Save Forecasting Report offers an eight-week projection of subscription demand, breaking down active subscriptions and scheduled units per week.

The Brand Metrics Dashboard is another valuable tool. It highlights "New-To-Brand" subscribers and provides category benchmarks, allowing you to measure your performance against competitors. If you’re using Vendor Central, you’ll also gain access to additional reports like Sales Performance (revenue penetration), Coupon Performance, Funding Performance (conversion by discount tier), and Inventory Performance, which tracks revenue lost due to stockouts. Let’s dive into the key metrics and actionable strategies to help you boost your Subscribe & Save performance.

Key Subscribe & Save Metrics to Monitor

One of the most crucial metrics is Revenue Penetration, which measures the share of Subscribe & Save revenue compared to your total product revenue. For instance, in the pet supplies category, subscriptions account for 28% of total revenue, with dog food reaching as high as 58%. If your numbers fall short of these benchmarks, it’s time to take action. Another critical metric is Subscriber Retention Rate.

"A good benchmark is to keep your retention rate at or above 90% after 30 Days and above 75% after more than 90 Days" – Martin Heubel, Founder of Consulterce.

High Out-of-Stock (OOS) Rates are a major red flag, as they often lead to subscription cancellations. Using the Inventory Performance Report, you can track revenue lost due to stockouts. Additionally, New-To-Brand Subscribers helps determine whether customers are subscribing on their first purchase or require multiple one-time purchases before committing. Lastly, keep an eye on Active Subscriptions, which reflect the total number of subscriptions active at the end of a given period. This metric is a direct indicator of your loyal customer base.

| Metric | What It Measures | Why It Matters |

|---|---|---|

| Revenue Penetration | SnS Revenue / Total Product Revenue | Shows how much of your business relies on recurring revenue. |

| Subscriber Retention Rate | % of shoppers staying subscribed for 30/90+ days | Indicates long-term loyalty and satisfaction. |

| OOS Rate | % of units not delivered due to stockouts | High rates lead to churn and lost trust. |

| New-To-Brand Subscribers | First-time buyers who subscribe immediately | Reflects the strength of your SnS offer. |

| Active Subscriptions | Count of active subscriptions at period end | Measures the size of your loyal customer base. |

By understanding these metrics, you’ll be better equipped to implement strategies that enhance both enrollment and retention.

Steps to Increase Subscribe & Save Enrollment and Retention

Start by optimizing your product detail pages with A+ Content. Include feeding charts, serving instructions, and clear subscription savings to show pet owners exactly how much they’ll save and how often they’ll need to reorder. Next, use strategic couponing to incentivize first-time subscriptions. Tools like "Vendor Powered Vouchers" or Subscribe & Save Coupons can offer a one-time discount on the first delivery, encouraging initial sign-ups. Every $1 spent on these coupons can generate $19 in profit over 18 months.

Align pack sizes with consumption rates. Offering 30, 60, or 90-day supply packs ensures customers neither run out nor accumulate excess inventory. Maintaining a high in-stock rate (ideally 85% or more) is also critical. Missed deliveries due to stockouts erode customer trust and lead to cancellations. Consider bundling complementary items, like pairing dry food with dental treats, to boost average order value and encourage multi-item subscriptions.

On the advertising front, tools like Amazon Marketing Cloud (AMC) can help refine your strategy. Use "Negative Audiences" to exclude current subscribers from retargeting ads, saving ad spend, and "Upsell Audiences" to promote complementary products to loyal subscribers. Offering a 10%–15% Subscribe & Save discount can increase conversion rates by up to 1.8x. With roughly 35% of Amazon shoppers having subscribed to a product at least once, the potential is enormous – provided you’re tracking the right metrics and continuously optimizing your approach.

How Emplicit Helps Pet Brands Maximize Subscribe & Save Results

Managing a successful Subscribe & Save program on Amazon requires a mix of expertise in PPC, inventory forecasting, and account health. Emplicit combines the power of Amazon Marketing Services (AMS) and Demand-Side Platform (DSP) to target high-intent shoppers. While DSP focuses on building awareness at the top of the funnel, AMS works as a "safety net" to capture shoppers already browsing within Amazon’s ecosystem. This dual approach minimizes missed opportunities and ensures that traffic translates into subscribers.

From January to August 2024, a pet brand specializing in litter partnered with Emplicit to tackle advertising restrictions on a key ASIN. Emplicit introduced a Hero ASIN strategy, directing traffic to parent product pages even when specific variations were unavailable for ads. Over eight months, this strategy generated over 8 million ad impressions, increased revenue by 46%, and boosted unit sales by 30%, bringing in thousands of new Subscribe & Save customers.

"Working with Brandwoven has been a game-changer. Their expertise in Amazon marketplace management for pet products has streamlined our operations and significantly boosted our sales performance… [generating] new Subscribe & Save customers." – Ecommerce Business Development Manager, Pet Brand

Emplicit doesn’t stop at campaign execution. The agency digs deeper into data using Amazon Marketing Cloud (AMC) to uncover insights like "Brand Halo" conversions – sales of products other than the one being advertised. For the litter brand, these additional sales contributed to 18% of total revenue from integrated campaigns. Emplicit also creates custom remarketing audiences, targeting past shoppers who may need refills and even customers from competitors that have exited the market.

To complement its ad and remarketing efforts, Emplicit keeps a close eye on the Amazon Subscription Dashboard. This ensures that inbound shipments align with forecasted demand, reducing the risk of stockouts that lead to subscription cancellations. By optimizing account health weekly and maintaining FBA compliance – a must for Subscribe & Save eligibility – Emplicit helps pet brands build a steady revenue stream, laying the groundwork for long-term success on Amazon.

Conclusion

Subscribe & Save has become a cornerstone for driving long-term success in the pet industry. High subscription rates, particularly in dog and cat food categories, highlight the effectiveness of this model. These subscriptions offer more than just steady cash flow – they lower customer acquisition costs, enhance operational efficiency, and streamline inventory planning. In essence, they provide a reliable pulse on market demand, shaping decisions across marketing, inventory, and beyond.

Customers who subscribe are significantly more valuable than one-time buyers, contributing three times the revenue and 13% more wallet share. With the pet care market expanding at an impressive 25.3% year-over-year, ignoring subscriptions could mean falling behind competitors and losing critical market share.

Key strategies like tailoring packaging to match consumption habits, offering strategic 10% discounts, leveraging AMC-powered audience targeting, and maintaining disciplined inventory management are essential for sustainable growth on Amazon.

Pet owners appreciate the ease of having essentials automatically delivered without the hassle of reordering every month. Brands that prioritize a seamless subscription experience – ensuring reliable stock, competitive pricing, and clear value – can secure a loyal spot in their customers’ routines. On the other hand, brands that fail to meet these expectations risk wasting advertising budgets trying to recapture the same customers over and over again.

FAQs

How can Amazon’s Subscribe & Save program help pet brands grow financially?

Amazon’s Subscribe & Save program provides pet brands with a dependable way to generate repeat sales while improving conversion rates. By offering customers discounts ranging from 10% to 15%, brands can see conversion rates climb by as much as 1.8×. On top of that, the program’s recurring orders and tiered discount structure – 10% off, with an additional 5% for customers subscribing to five or more items – help establish predictable revenue streams. This consistency supports better cash flow management and enhances customer lifetime value.

With its ability to drive loyalty, ensure steady sales, and boost retention, Subscribe & Save serves as a valuable tool for fostering long-term business growth.

What key metrics should pet brands monitor for success with Amazon Subscribe & Save?

To make Amazon Subscribe & Save work for your pet brand, it’s all about keeping an eye on the right metrics – those that reveal the health of your subscriptions and how loyal your customers are. A great place to start is Amazon’s Subscribe & Save Forecasting Report. This report gives you a clear picture of what to expect over the next eight weeks, including anticipated subscription orders, average discounts, and the number of active subscriptions. Combine this with the Subscribe & Save Performance Report, which offers insights into weekly order volumes, out-of-stock rates, and average sale prices.

But don’t stop there. Dive deeper into retention and repeat-purchase metrics to truly understand customer loyalty. Pay attention to key metrics like 30-day and 90-day retention rates, reorder frequency, and the lifetime value (LTV) of subscribers compared to non-subscribers. Many successful pet brands see subscriber LTV soar by more than 50% and reorder rates double after implementing Subscribe & Save. Keeping a close watch on these numbers helps you fine-tune your pricing, manage inventory effectively, and run promotions that drive growth while keeping your customers happy.

Why are pet products ideal for Amazon’s subscription model?

Pet products are a natural fit for Amazon’s Subscribe & Save program. Why? Because they’re everyday essentials that pet owners need on a regular basis – think food, litter, treats, and grooming supplies. These items are often bought on a predictable schedule, so automatic refills make life easier by ensuring you never run out of the basics.

Pet owners also tend to view their furry friends as family, which means they’re more than willing to pay for convenience and reliability. With Subscribe & Save, they not only get discounts (ranging from 5% to 15% depending on the order) but also the reassurance that their must-have items will always be in stock. For brands, this isn’t just about happy customers – it’s about recurring revenue. Subscription shoppers typically spend more than one-time buyers, making this model a win-win. The steady demand, combined with customer loyalty and ease of use, makes pet products a perfect match for subscription services on Amazon.

Related Blog Posts

- The Amazon Metric Pet Brands Obsess Over (That Actually Doesn’t Matter)

- After Managing $50M in Pet Brand Sales, Here’s What Actually Moves the Needle on Amazon

- Most Pet Brands Optimize for Amazon Keywords. The Best Ones Optimize for This Instead.

- Amazon Subscribe & Save Isn’t a Feature. It’s a Strategy. Most Pet Brands Treat It Like a Checkbox.