Navigating sales tax for digital products can be tricky. States have varying rules on what counts as a taxable digital product, economic nexus thresholds, and marketplace facilitator laws. Here’s a quick overview:

- Digital Products: Items like eBooks, software, and music downloads. Tax rules differ by state – some tax them like physical goods, others exempt them.

- Economic Nexus: Most states require tax collection if you hit $100,000 in sales or 200 transactions, though thresholds vary (e.g., $500,000 in California, Texas, and New York).

- Marketplace Facilitator Laws: Platforms like Amazon or Etsy collect and remit sales tax for you, but you’re still responsible for direct sales (e.g., your own website).

- 2026 Updates: Illinois removes its transaction threshold, Maine adds taxes on digital subscriptions, and D.C. raises its digital goods tax rate.

To stay compliant:

- Identify where you have nexus (economic or physical).

- Register for sales tax permits in those states.

- Understand if your products are taxable in each state.

- Use tax automation tools like TaxJar or Avalara for calculations and filings.

- File returns regularly – even if no tax is owed.

Managing sales tax for digital products requires staying updated on state laws and using tools to simplify compliance.

How Sales Tax Works for Digital Products

What Counts as a Digital Product?

Digital products are intangible items delivered electronically. Think of things like software, eBooks, music downloads, streaming videos, online courses, and mobile apps. However, the exact definition of a digital product can vary depending on the state. For instance, the 24 member states of the Streamlined Sales and Use Tax Agreement classify items like digital audio, digital books, and audiovisual works as "Specified Digital Products". On the other hand, Washington State takes a broader approach, including services like photo-sharing platforms and Remote Access Software (RAS) under its definition.

One of the biggest challenges for sellers is that states differ on whether digital goods are treated as "tangible personal property." In some states, digital products are taxed just like physical goods, while in others, they’re exempt because they lack a physical form. Alabama clarified its stance with this statement:

"the form in which tangible property is delivered by the seller to the purchaser is of no consequence"

In simple terms, Alabama treats digital downloads the same as physical items for tax purposes.

Understanding how states define digital products is key to navigating the complex tax rules that come with selling them.

How States Tax Digital Products Differently

Once you understand what qualifies as a digital product, the next step is figuring out how different states handle taxes on them. The rules vary significantly. For example, California generally exempts digital goods unless they’re sold with physical storage media, while Texas taxes digital products if their physical counterparts would also be taxable. Meanwhile, New York exempts most digital media like movies and music, even though physical versions of these items, like DVDs and CDs, are taxable.

State tax rules often depend on two factors: how the product is delivered and the type of usage rights granted. Some states only tax digital goods when the buyer receives permanent usage rights, leaving subscription-based services untaxed. Connecticut takes a unique approach, applying a 6.35% tax rate to digital goods for personal use, but offering a reduced 1% rate for canned software purchased for business use.

Recent updates show a trend toward broader taxation of digital products. Several states are revising their tax rules for 2024 and 2025, and Virginia is even considering updates for 2026.

Adding to the complexity is the growing use of destination sourcing. This method bases the tax rate on the buyer’s billing address or where the product is first accessed, rather than the seller’s location. To stay compliant, sellers need to track customer billing details or access locations to ensure the correct tax rate is applied.

Webinar: Sales tax 101: Mastering Compliance for Software, SaaS, and Digital Products

Economic Nexus Rules for Marketplace Sellers

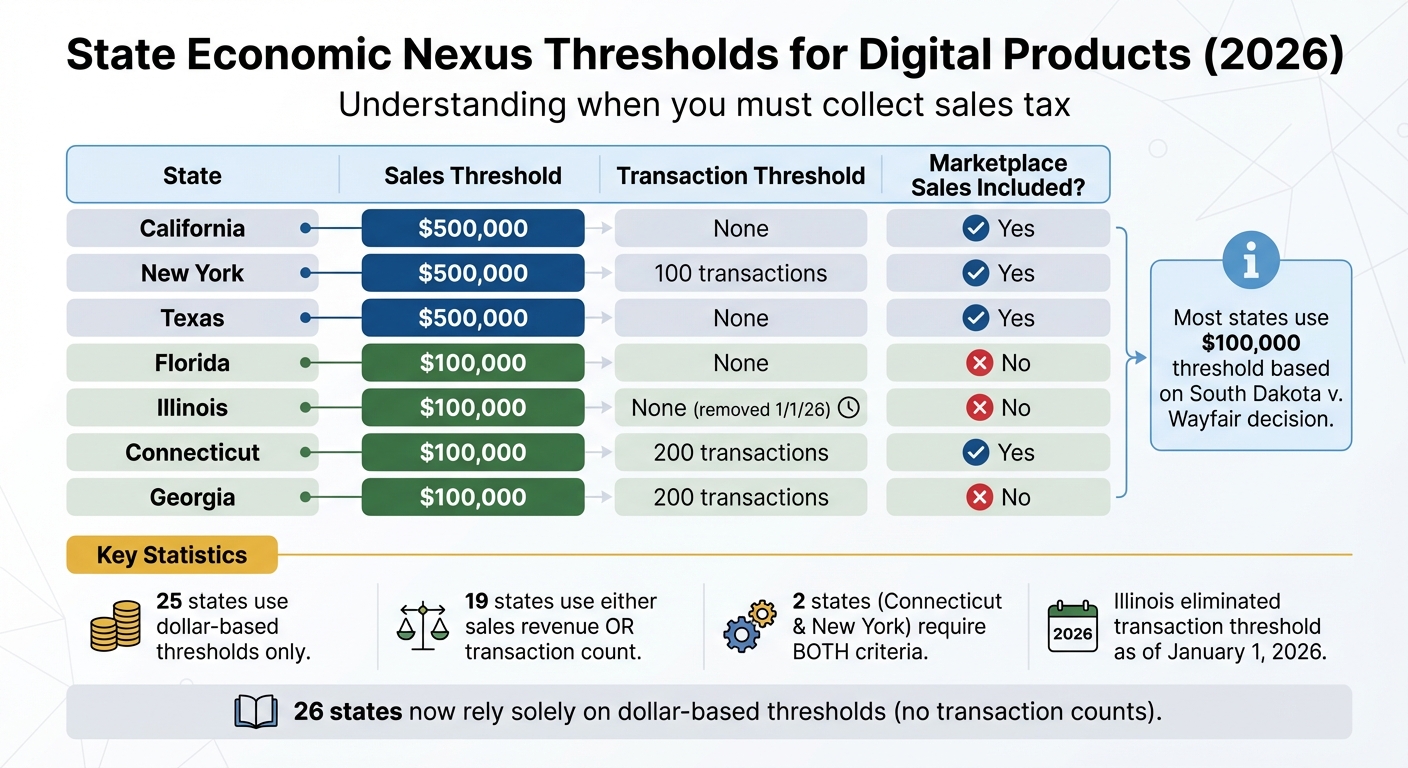

State-by-State Economic Nexus Thresholds for Digital Product Sellers 2026

State-by-State Economic Nexus Thresholds

Economic nexus refers to a tax collection obligation that kicks in once your sales revenue or transaction volume in a state exceeds specific limits, even if you don’t have a physical presence there. This applies even if you’re selling exclusively through marketplaces like Amazon or TikTok Shops.

Most states have adopted thresholds based on the South Dakota v. Wayfair decision, typically set at $100,000 in sales. However, some states, like California, New York, and Texas, have higher thresholds – $500,000 in sales. New York adds an extra layer by requiring more than 100 transactions alongside the $500,000 sales mark.

Interestingly, fewer states are sticking to transaction count requirements. For example, Illinois eliminated its 200-transaction threshold as of January 1, 2026, joining 25 other states that now rely solely on dollar-based thresholds. States like Indiana, North Carolina, and South Dakota have also dropped transaction counts to ease the compliance load for smaller sellers.

Here’s an important note: most states require marketplace sales to be included when calculating whether you’ve hit their economic nexus threshold. For instance, if you sell $73,000 on Amazon and $52,000 through your own website in a state with a $100,000 threshold, your combined $125,000 surpasses the limit. However, a few states – Florida, Illinois, and Georgia – exclude marketplace sales from the individual seller’s threshold calculation.

| State | Sales Threshold | Transaction Threshold | Marketplace Sales Included? |

|---|---|---|---|

| California | $500,000 | None | Yes |

| New York | $500,000 | 100 | Yes |

| Texas | $500,000 | None | Yes |

| Florida | $100,000 | None | No |

| Illinois | $100,000 | None (as of 1/1/26) | No |

| Connecticut | $100,000 | 200 | Yes |

| Georgia | $100,000 | 200 | No |

Understanding these thresholds is crucial for managing your tax obligations, especially if you sell digital products.

How Economic Nexus Affects Digital Product Sellers

Economic nexus rules add another layer of complexity for digital product sellers, as taxability varies widely by state. Whether or not a product is taxable can directly impact how these thresholds apply to your sales.

For example, if you sell eBooks that are exempt in a specific state, you’ll need to check whether that state calculates economic nexus based on gross sales or taxable sales. This distinction can significantly affect whether you meet the threshold.

Physical presence also creates nexus, regardless of economic thresholds. If you use Amazon FBA and your inventory is stored in a warehouse within a state, you automatically have physical nexus there. This means you’re required to register and collect tax in that state, even if your sales don’t reach the economic nexus threshold.

The Tax Foundation has emphasized the challenges sellers face:

"The increased compliance costs are further compounded by the lack of uniformity among the various taxing jurisdictions".

With online sales expected to hit $8.1 trillion by 2026, keeping track of your sales across multiple states and platforms is more important than ever. Whether you’re selling on Amazon, TikTok Shops, your own website, or other platforms, it’s essential to monitor your total sales to see if you’ve triggered economic nexus in any state. If you exceed a threshold, register and start collecting tax promptly.

Marketplace Facilitator Laws and What They Mean for Sellers

How Marketplace Facilitator Laws Work

Marketplace facilitator laws shift the responsibility of collecting sales tax from individual sellers to the platforms they use. Currently, all 45 states with a state-level sales tax, plus Washington, D.C., have adopted these laws. This means platforms like Amazon, eBay, TikTok Shops, and Walmart now handle the tax collection process for sales made through their systems.

"Marketplace facilitator laws impose an obligation on the platform that facilitates the sale… to collect and remit sales tax on behalf of the marketplace seller." – Avalara

These platforms take on this responsibility because they provide the infrastructure for the marketplace, process payments, and often manage fulfillment. Amazon, for instance, was an early adopter of comprehensive tax collection, now covering every state with marketplace facilitator laws. Some states, such as Arkansas, Kentucky, Louisiana, Maine, and Puerto Rico, even include digital goods like "digital products", "digital codes", or "electronically transferred property" under these requirements.

However, these laws don’t apply everywhere. States without a general sales tax – New Hampshire, Oregon, Montana, and Delaware – are exempt. Alaska, while lacking a state-level sales tax, allows local jurisdictions to impose their own taxes, which can lead to situations where platforms may not collect all local taxes.

The thresholds for tax collection vary by state. Most platforms start collecting tax once sales hit $100,000 or 200 transactions, but New York has a higher threshold of $500,000 and 100 transactions. Many states also offer liability protection to platforms if sellers provide incorrect tax information, as long as the seller isn’t affiliated with the platform.

Even though platforms now handle much of the tax collection, sellers still have their own tax responsibilities to manage, depending on where and how they sell.

What Sellers Still Need to Manage

While marketplace platforms take care of tax collection for sales processed through their systems, sellers still have tax obligations for other channels. If you sell products or services through your own website or any platform not classified as a marketplace facilitator, you’re responsible for collecting and remitting sales tax yourself. For example, if you sell digital products on both Amazon and your own ecommerce site, you’ll need to handle tax collection for sales made directly through your site.

Traditional tax rules still apply, too. Economic or physical nexus laws can create additional obligations. For instance, storing inventory in a fulfillment center, such as through Amazon FBA, often requires you to register for a sales tax permit in that state and file returns, regardless of marketplace facilitator laws. Some states, like New York, mandate that all sellers – home-based businesses included – register for a sales tax permit, even if all their sales occur through a marketplace.

Sellers also need to file "zero returns" in many states. These returns report gross receipts and deductions for marketplace sales, even when no tax is owed. Missing these filings can lead to automatic penalties, though some states, like New Jersey, allow sellers to request "non-reporting basis" status if they exclusively sell through marketplaces.

It’s also important to keep documentation confirming that marketplaces are collecting taxes on your behalf. This could include a Certificate of Collection, like Form ST-150 in New York, or a publicly available agreement from the platform. Keeping these records organized is essential in case of an audit.

sbb-itb-e2944f4

How to Comply with Sales Tax Rules for Digital Products

Building on the nexus and regulatory details discussed earlier, here’s a step-by-step guide to help you stay compliant.

Step 1: Identify States Where You Need to Collect Tax

Sales tax collection hinges on having a nexus – a significant connection to a state. Nexus can arise from a physical presence (like offices, employees, or inventory in fulfillment centers) or economic activity (meeting specific sales thresholds).

Each state sets its own sales thresholds, so you’ll need to check the rules for each one. For instance:

- 25 states base thresholds solely on sales revenue.

- 19 states consider either sales revenue or the number of transactions.

- Connecticut and New York require meeting both criteria simultaneously.

Use tools like accounting software or marketplace dashboards to track sales by state. If you use Amazon FBA, the Inventory Event Detail report can pinpoint when your inventory entered a state, which creates physical nexus immediately – regardless of sales volume.

"Pretty much every single new client that we have coming into our systems has nexus in a state somewhere because of online advertising."

- Alex Oxford, Founder, TaxValet

Important: Even if a marketplace collects taxes on your behalf, you’re still responsible for filing returns for sales through your own website or in states where you have a physical nexus.

Step 2: Register for Sales Tax Permits

Once you’ve determined where you have nexus, the next step is registering for sales tax permits in those states. You must secure these permits before collecting any tax – doing so without a permit is illegal and could be considered theft.

To register, you’ll need:

- Your EIN or SSN

- Legal business name

- Business structure

- NAICS code (most online sellers use 454110)

Applications are processed through each state’s Department of Revenue website, with fees and processing times varying by state.

"It’s illegal to collect sales tax without a valid sales tax permit within certain states. From the government’s perspective, if you are collecting without a permit, you may be keeping that money in your pocket."

- Alex Oxford, CMI, Founder, TaxValet

After registration, the state assigns a filing frequency – monthly, quarterly, or annually. Even if you owe no tax, you’re required to file returns.

Step 3: Determine If Your Products Are Taxable

The taxability of digital products varies widely by state. Some states treat digital goods like eBooks, software downloads, and streaming services as taxable, while others exempt them or tax them under specific conditions.

For example, a state might tax downloaded software but exempt cloud-based SaaS products or tax digital art but not online educational courses. Laws can be slow to adapt to technological changes, so it’s essential to stay updated.

Since digital products don’t involve shipping addresses, use the customer’s billing address to determine which state’s tax rules apply. Keep detailed records of how you classify your products – audits are costly, with the average sales tax audit exceeding $115,000.

Step 4: Use Sales Tax Automation Software

Managing tax calculations across 11,000+ U.S. jurisdictions is nearly impossible without automation. For example, Texas alone has 1,900 jurisdictions. Tools like TaxJar, Stripe Tax, or Avalara can handle calculations, track nexus thresholds, file returns, and even manage payments.

"TaxJar’s Nexus Insights Dashboard makes it easy to see which states require you to collect sales tax based on your economic activity without having to rely on manual workflows."

- TaxJar

Set up automation before you start collecting taxes to avoid costly errors. Penalties for mistakes can range from 20% to 30% of the tax due.

Step 5: File Returns and Pay Taxes

Your filing frequency depends on your sales volume in each state:

- Monthly for high-volume sellers

- Quarterly for moderate sales

- Annually for minimal activity

Even if you have no tax liability, file zero returns to confirm gross receipts and tax collection. Missing filings can result in penalties.

Most states require payments via ACH transfer from a U.S. bank account. Automation tools can help you track deadlines and even submit payments, reducing the risk of late fees.

Keep detailed records of all filings and payments. States can audit up to three or four years back, and unpaid taxes can lead to personal liability, including liens on personal assets.

2026 Compliance Checklist and Tools

What’s Changing in 2026 for Digital Product Taxes

As the tax landscape continues to evolve, 2026 brings some notable changes for digital products. Starting January 1, 2026, Maine will begin taxing digital audio and audiovisual works. This means services like Netflix, Hulu, and Spotify subscriptions will now be subject to sales tax. In Illinois, the rules are shifting on the same date – remote sellers will no longer need to meet the 200-transaction threshold. Instead, only $100,000 in sales will be required to trigger economic nexus.

In the District of Columbia, the sales tax rate on digital goods will increase from 6% to 7%, effective October 1, 2026. If you sell digital products to customers in D.C., make sure to update your tax calculations before this rate change takes effect. Meanwhile, Washington State is introducing a Voluntary Disclosure Agreement (VDA) program specifically for international remote sellers and marketplace facilitators. Running from February 1 to May 31, 2026, this program offers a limited lookback period and can waive up to 39% in penalties.

The trend of states updating their tax codes to capture revenue from digital commerce is clear. In fact, 2025 alone saw over 400 sales tax rate changes across the United States. With global digital sales continuing to grow, it’s essential to review your product classifications – whether for streaming services, SaaS, or subscription content – to ensure compliance with these updates.

To keep up with these changes, using reliable tax automation tools is becoming more important than ever.

Tools and Services for Tax Automation

Manually managing tax compliance can be a time sink, especially for businesses filing in multiple states. On average, this process takes about 45 hours per month. Automation tools can help streamline this workload by handling tasks like tax calculations, nexus monitoring, return filing, and remittance.

- TaxJar: This platform features a Nexus Insights Dashboard that alerts you when you’re nearing economic nexus thresholds. Their AutoFile service takes care of filing and remittance, and they even offer a 30-day free trial.

- Avalara AvaTax: Known for its automated tax calculations, Avalara adapts to the specific rules of different states, ensuring accurate compliance.

- TaxCloud: This tool automates tax calculations, filing, and remittance. For eligible sellers, it even provides free filing in Streamlined Sales Tax (SST) states.

If your business operates across multiple marketplaces – such as Amazon, TikTok Shops, Walmart, or your own ecommerce site – Emplicit is another option worth exploring. They offer a range of e-commerce services, including marketplace management, account health monitoring, and inventory oversight. Their team can also support tax compliance efforts alongside services like PPC management and listing optimization. To learn more, visit Emplicit.

Conclusion

Navigating sales tax compliance for digital products becomes far simpler when you understand the basics: your nexus, which products are taxable, and the responsibilities your marketplace handles. Even with marketplace support, you’ll still need to maintain accurate records and file returns. This groundwork helps you stay prepared for the ever-evolving tax landscape.

Keep a close eye on your sales across all channels to monitor when you reach economic nexus thresholds, like the $500,000 limit in states such as Texas or New York. As Stripe highlights, “Sellers are liable for tax if the marketplace facilitator does not collect it”, making it essential to ensure your product information is accurate.

The constant changes in tax regulations can create operational challenges, especially for businesses selling across multiple platforms. Managing these complexities can stretch your resources thin. That’s where services like Emplicit come in – they offer a range of ecommerce solutions, from marketplace management to PPC campaigns, to help you stay tax compliant while focusing on scaling your business. For more details, visit Emplicit.

To stay ahead, make compliance part of your growth strategy: register in states where required, automate your tax processes, and maintain thorough records. These steps not only help you meet state tax laws but also strengthen your overall compliance approach.

FAQs

How do marketplace facilitator laws impact my sales tax obligations?

Marketplace facilitator laws place the responsibility on platforms like Amazon and TikTok Shops to collect and remit sales tax for most transactions on their marketplaces. This generally means that sellers don’t need to handle sales tax themselves in states where these laws are in effect.

That said, there are exceptions. If you surpass a marketplace’s thresholds or sell directly to customers outside the platform, you might still need to register and file sales tax. It’s crucial to review your specific obligations to ensure you’re meeting state requirements.

What are the major updates to sales tax rules for digital products in 2026?

In 2026, several states are broadening sales tax regulations to include more digital products. This expansion covers items like streaming services, software subscriptions, SaaS platforms, and other digital goods. At the same time, states are tightening economic nexus rules. For instance, Illinois has eliminated transaction thresholds, meaning businesses may owe taxes regardless of the number of sales made.

States are also tweaking exemptions and modifying local tax rate structures. However, no states have introduced increases to their statewide base tax rates. Companies involved in selling digital products should closely examine these updates to stay compliant with the evolving tax requirements.

How can I comply with state sales tax rules for digital products sold on marketplaces?

To navigate state sales tax rules for digital products, the first step is identifying which states tax your digital goods. Tax laws differ from state to state, and items like e-books, streaming services, or software may fall under different tax categories. Currently, about 25 states impose taxes on digital goods, so it’s essential to understand each state’s specific definitions and regulations.

Next, figure out where you have a nexus – a connection to a state that obligates you to collect sales tax. Many states enforce an economic nexus threshold, commonly set at $100,000 in sales or 200 transactions annually. If your business exceeds a state’s threshold, you’ll need to register for a sales tax permit before conducting taxable sales there.

Lastly, streamline your tax compliance by automating the process. Tax calculation tools can ensure accurate rates at checkout, track exempt sales, and create detailed reports for filing. Keeping thorough transaction records and staying updated on state law changes are key to staying compliant. For added ease, consider working with a full-service ecommerce provider like Emplicit. They can handle marketplace registration, tax system integration, and compliance, allowing you to focus on growing your business while staying prepared for audits.